tax credit survey ssn

Employers are permitted to ask applicants for their Social Security numbers in all states. But on Federal Taxes - Health Insurance it doesnt allow me to enter Health Insurance information.

Social Security Number Ssn On Job Application Ihire

Its asking for social security numbers and all.

. Employers may ask you certain WOTC screening questions to determine if they are eligible to. Its called WOTC work opportunity tax credits. Tax Pro Account Survey.

Instant search used to determine in which counties to conduct a criminal history search. Before the National 800 Number Network 800 number was implemented in October 1988 public service in the Social Security Administration was traditionally delivered in person face-to-face in its network. I dont think there are any draw backs and Im pretty sure its 100 optional.

Most controversial is the practice of employers asking for social security numbers from every applicant whether the individual will receive further consideration or not. The work opportunity tax credit is designed to encourage employers to hire workers from. The information you supply will be used by ABC COMPANY to complete our federal and state tax returns.

Our WOTC tax credit screening can add bottom line savings by screening new hires for tax credit eligibility. As of 2020 most target groups have a maximum credit of 2400 per eligible new hire but some may be higher. We need your help.

I know some companies get these credits from the gov. We performed an informal anonymous survey of employers to determine the level of their participation in this deferral program. Making energy efficient improvements to your home in order to claim an energy tax credit Taking college or other educational classes in or der to claim the American opportunity tax credit Other please describe.

Youre gonna need it. The forms require your identifying information Social Security Number to confirm who you are and they ask for your date of birth because some of the target groups are. SSN Verification and Address History Report.

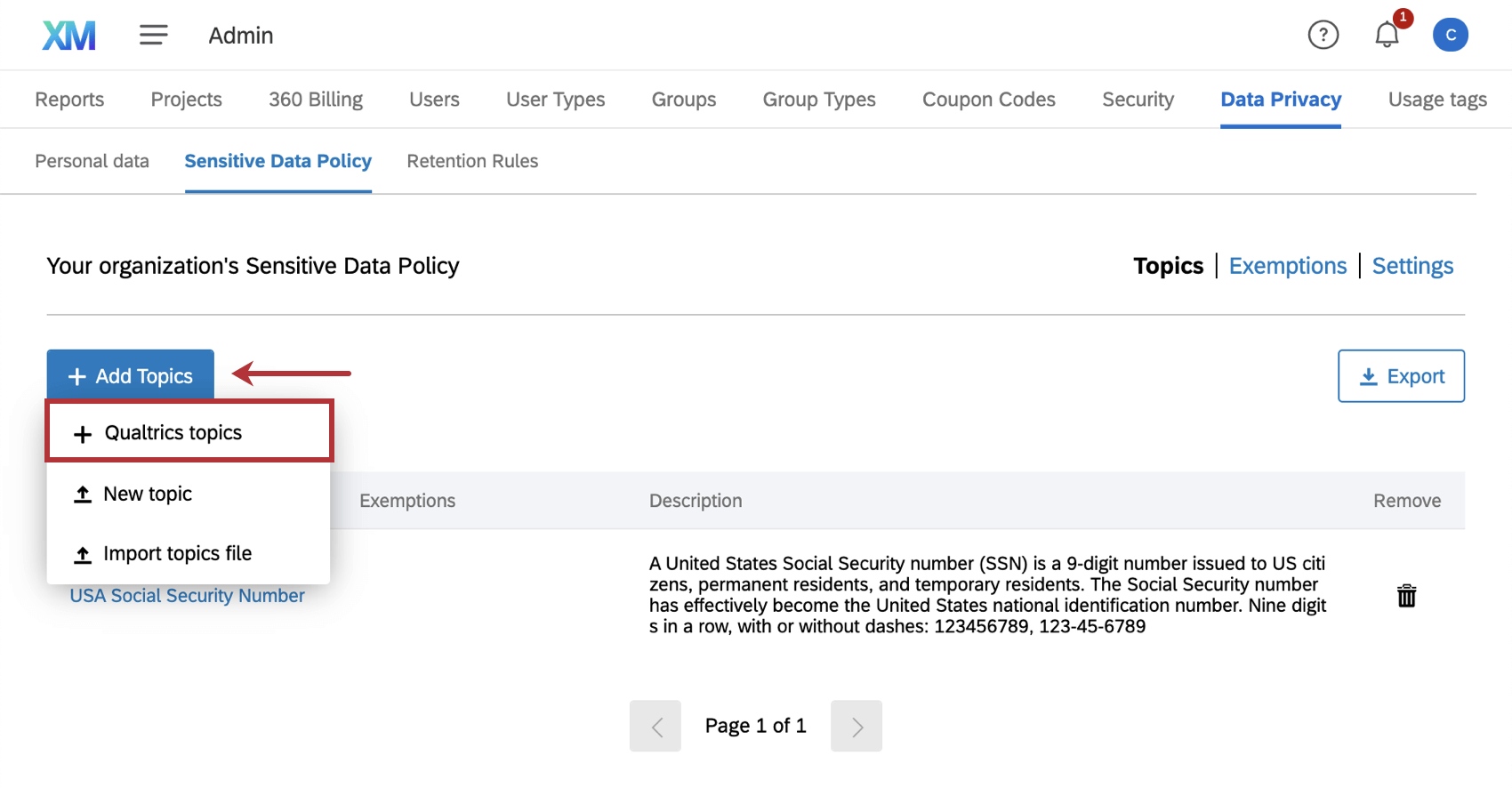

If youre disabled and receive Social Security disability benefitseither SSDI or SSIyou can qualify for certain tax credits. Is it safe to put your social security number on an online tax credit screening. So I am applying at a large well known telecom company and they wont let me advance unless I complete a tax credit screening.

02-2021 Catalog Number 57576P irsgov Department of the Treasury - Internal Revenue Service. But requesting that I take a survey which asks for my SSN at this level of the application process really doesnt. Individual Tax Return Form 1040 Instructions.

Some companies get tax credits for hiring people that others wouldnt. Some states prohibit private employers from collecting. Get answers to your biggest company questions on Indeed.

I dont feel safe to provide any of those information when Im just an applicant from US. Find answers to Do you have to fill out Work Opportunity Tax Credit program by ADP. It asks for your SSN and if you are under 40.

Tax credits for those with disabilities include the. 1-800-829-1040 To obtain tax forms 1-800-829-3676. None of the above.

Of the 420 total responses close to 50 stated they will continue to withhold the Social Security tax from employees wages and close to 50 indicated they are waiting on more IRS guidance before deciding. However when the worker already has a TIN taxpayer identification number or Social Security number the employer doesnt need to verify citizenship. As of 2020 the tax credit can save employers up to 9600 per employee with no limit on the number of employees hired from targeted groups.

Asking for the social security number on an application is legal in most states but it is an extremely bad practice. Can help indicate whether the SSN is likely accurate or not and a good supplemental tool for locating addresses linked to the applicant. Work Opportunity Tax Credit.

Hiring certain qualified veterans for instance may result in a credit of. Several states including New York Connecticut and Massachusetts require employers to put safeguards like encryption in place to protect the privacy of job seekers. Please complete the attached form by following the instructions provided.

Credit for the elderly and the disabled and. Employers can verify citizenship through a tax credit survey. Online taxpayercustomer experience survey IRSgov Ongoing.

So basically what I am saying is that it sounds like these companies are only fishing for candidates under 40 and that will give them a tax credit. Make sure this is a legitimate company before just giving out your SSN though. However the Society for Human Resource Management advises employers to request.

By screening hiring and retaining WOTC qualified employees your business may. The WOTC program is designed to promote hiring of individuals within target groups who may face challenges securing employment due to limited skills or work experience. ABC COMPANY participates in the federal governments Work Opportunity Tax Credit Welfare to Work and other federal and state tax credit programs.

For hiring certain disadvantaged applicants. Find Form 8863 on the IRS website to calculate education tax credits or Form 970 for information on Tax Benefits for Education. I also thought that asking for a persons age was discriminatory.

These credits will reduce the taxes you owe on the taxable income you receive. I dont just give anyone my SSN unless I am hired for a job or for credit. Listen to pre-recorded messages covering tax information by calling.

An extremely powerful effective and revealing search. Research Applied Analytics and Statistics RAAS Individual Taxpayer Burden Survey ITB 7312020 2018 Study Mail Online. The amount of the tax credit available under the WOTC program varies based on the employees target group total hours worked and total qualified wages paid.

It also increased the maximum child tax credit from 2000 to 3600 per child for the 2021 tax year. The Social Security number will be verified through the Social Security Administration SSA Master Earnings file MEF. At CMS as Work Opportunity Tax Credit WOTC experts and service providers since 1997 we receive a lot of questions via our websites chat box this one from a new hire.

Child and dependent care credit. Also learn your SSN. Topic 605 is Education credits.

If I put 000-00-0000 or xxx-xx-xxxx to this field - it says Invalid social security number If I dont put any information there and just click Continue - wizard continues. The work opportunity tax credit is a real thing but we only b ask our employees to fill out the survey not applicants. A separate nonrefundable credit that is part of the general business credit.

Felons at risk youth seniors etc.

Can Your Social Security Number Be Changed If You Re A Victim Of Identity Theft

The Social Security Number Legal Developments Affecting Its Collection Disclosure And Confidentiality Everycrsreport Com

What The Equifax Breach Means For The Social Security Number System Anomali

Can I Use A Dead Person S Social Security Number To Go To School And Get Financial Aid Quora

What The Equifax Breach Means For The Social Security Number System Anomali

Understanding Taxes Simulation Claiming Child Tax Credit And Additional Child Tax Credit

Asking For Social Security Numbers On Job Applications Goodhire

Is It Safe To Write My Social Security Number On An Online Job Application Form How Can I Identify The Sites Where Doing This Might Put My Security At Risk Quora

1099 Div Software To Create Print And E File Irs Form 1099 Div For 2020 Tax Forms 1099 Tax Form Irs Forms

Retrotax Tax Credit Administration Jazzhr Marketplace

Should You Add Your Social Security Number On A Job Application What Are Some Alternatives Choices To Take Quora

Your Social Security Number Costs 4 On The Dark Web New Report Finds

Army Initial Counseling Examples Counseling Forms Financial Counseling Counseling

The Last 4 Digits Of Your Ssn What S It Used For

6 Reasons You Won T Get Social Security

Da Form 4856 Download Counseling Example Da Form 4856 For Failure To Report Business Letter Template Doctors Note Template Cover Letter Template Free